Carteret County Real Estate Market Insights 2023

Unlocking the Potential: Carteret County Real Estate Market Insights for 2023 and Beyond

As we navigate through the ever-evolving Carteret County real estate landscape, it’s crucial to stay informed about local market trends and lending options. In this blog, we’ll delve into the latest market report for Carteret County, North Carolina, focusing on key statistics for the past several years and the current lending options available for FHA and VA loans.

Carteret County Market Report: 2022 Highlights

First, let’s take a look at the vital statistics that shaped the Carteret County real estate market in 2022. This information will provide valuable insights into the trends and conditions that continue to influence the area’s real estate market:

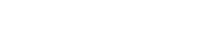

Carteret County Real Estate: Total Average Sales Price

In 2022, Carteret County saw a steady increase in the total average sales price for residential properties. The year-end Carteret County real estate residential average price was $501,567 reflecting a 15.02% increase compared to the previous year. This uptick in property values showcases the area’s desirability and potential for property appreciation.

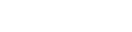

Days on Market:

Properties in Carteret County spent an average of 35 days on the market in 2022 vs. 44 in 2021. This relatively short time frame indicates a brisk selling pace and a competitive market. Buyers and sellers need to be prepared to act swiftly to secure their desired properties.

Carteret County Real Estate 2023 Market Snapshot: Year-to-Date

As we transition into 2023, it’s essential to keep an eye on the year-to-date trends in Carteret County’s real estate market. Data suggests the market remains robust.

Total Average Sales Price (YTD)

Year-to-date, the total average sales price in Carteret County continues to show promise. The current residential average stands at $522,035 maintaining an upward trajectory. This is indicative of sustained demand and a resilient housing market.

Days on Market (YTD)

Days on Market (YTD)

The days on the market for Carteret County real estate residential properties in 2023 (YTD) are averaging around 50 days. This suggests that the market remains competitive, and properties are selling relatively quickly.

Current Lending Options: FHA and VA Loans

For prospective buyers, understanding the lending options available is paramount. In Carteret County, FHA (Federal Housing Administration) and VA (Veterans Affairs) loans continue to be attractive options.

FHA loans are a popular choice for first-time homebuyers due to their low down payment requirements, typically as low as 3.5%. Additionally, FHA loans often offer competitive interest rates, making homeownership more accessible. VA loans are also an excellent option for eligible veterans and active-duty service members. These loans require no down payment, making them a fantastic opportunity for those who have served our country. VA loans also offer competitive interest rates and do not require private mortgage insurance (PMI).As we move further into 2023, these lending options remain favorable, providing opportunities for a wide range of buyers to enter the Carteret County real estate market.

FHA loans are a popular choice for first-time homebuyers due to their low down payment requirements, typically as low as 3.5%. Additionally, FHA loans often offer competitive interest rates, making homeownership more accessible. VA loans are also an excellent option for eligible veterans and active-duty service members. These loans require no down payment, making them a fantastic opportunity for those who have served our country. VA loans also offer competitive interest rates and do not require private mortgage insurance (PMI).As we move further into 2023, these lending options remain favorable, providing opportunities for a wide range of buyers to enter the Carteret County real estate market.

Bottom Line

In conclusion, the Carteret County real estate market has shown resilience and promise, with rising property values and competitive market conditions. While the market has cooled just a touch for some price points, statistics show that 2nd home beach markets remain strong. For those looking to buy, FHA and VA loans offer accessible and advantageous lending options. Whether you’re a first-time buyer or a seasoned investor, Carteret County presents a wealth of opportunities. Stay tuned for more updates on this thriving coastal real estate market, and don’t hesitate to reach out to our experienced agents at Bluewater Real Estate for personalized guidance and assistance.

Source: Atlantic Bay Mortgage, North Carolina Regional Multiple Listing Service