Carteret County Tax Re-Evaluation

A Quick Look Inside the Carteret County Tax Re-Evaluation Process

What to Expect

Property owners in Carteret County will soon receive a re-evaluation of their assets from the County Tax Office.

The re-evaluation process was pushed back one year due to the widespread damage due to Hurricane Florence in the Fall of 2018 and is the first adjustment since 2015.

Property appraisals will be calculated as close to their current status as of January 1st, 2020 as possible- and value letters will be sent out sometime within the first or second week in February.

The appeal process will then begin, with tax bills being mailed mid-fall once the rates are established by the County Commissioners.

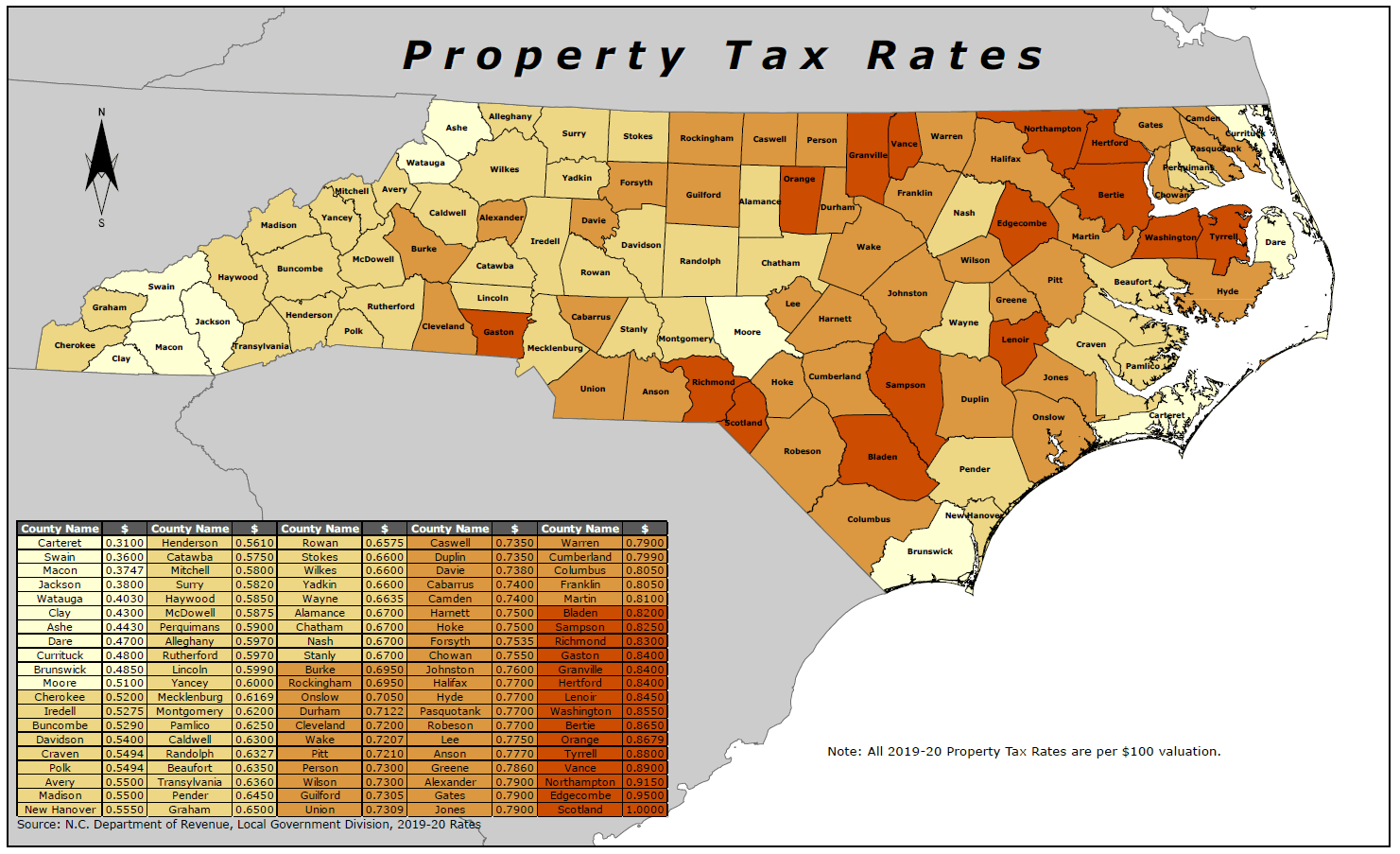

Did you know? For 2019, Carteret County residents enjoyed the lowest property tax rate in the state of North Carolina. The rate of .31% was unchanged from 2018.

* Image above is courtesy of the North Carolina Association of County Commissioners

Duties of the Assessor

The Assessor evaluates all property subject to taxation. The Assessor is required by North Carolina law to list, appraise and assess all property within the county at 100% of market value. In addition to the over 58,000 parcels of real property (land, homes, commercial buildings), the Assessor must value business personal property (approximately 7,000 businesses, ranging from multi‐million dollar enterprises to one-person operations). There are over 7,549 manufactured homes, over 77 aircraft, and over 26,129 boats, motors, and jet skis, and any other personal property which is taxable. There are over 6,500 motor vehicles that are billed monthly.

The Carteret County Tax Assessor’s Office creates over 150,000 tax notices annually. Because there is such a volatile real estate market, reappraisal for Carteret County is done every four years. The revaluation will include the use of county maps, aerial photography, street-level images, sales analysis, field visits, and other tools to gather data used in determining fair market value. Carteret County appraisers will review and analyze the information including comparable sales within your neighborhood.

Market Value is the most probable or most likely price that the property would sell for. It is not the highest, lowest, or average price. It requires a willing buyer and a willing seller with neither under any pressure to buy or sell. It implies that the buyer and the seller are fully informed of all the purposes to which the property is best adapted and is capable of being used. It recognizes the property’s current use as well as its potential use.

Appeal Process

If you agree with the Market Value stated in the Notice of Assessed Value, no further action is required.

If you wish to request an informal appeal, please chose from one of the three methods below:

1. An online appeal can be completed and submitted on the Carteret County Tax website

2. Email a scanned informal appeal form and any supporting documentation to taxinformation@carteretcountync.gov.

3. Mail the completed Informal Appeal Form and supporting documentation to:

Carteret County Tax Department

2020 Revaluation Appeal

302 Courthouse Square

Beaufort, NC 28516

*Online and emailed appeals will receive a confirmation email that the appeal was received by the Tax Department. All appeals will be reviewed by staff appraisers in the order that they are received. Your right to appeal to the Board of Equalization and Review is protected during the time the Tax Office is processing your Informal Appeal.

A REVIEW OF YOUR ASSESSMENT MAY RESULT IN YOUR VALUE BEING: UNCHANGED, REDUCED, OR INCREASED.

Valid Reasons to Appeal the Assessed Value

1. The market value substantially exceeds the actual market value of the property.

2. The market value is inconsistent with the market value of similar properties within your

neighborhood.

Invalid Reasons to Appeal the Assessed Value

1. The market value increased too much compared to the previous market value.

2. The market value is more than the insurance value.

3. The market value is just too high.

4. The owner does not have the financial ability to pay the taxes.

*All information courtesy of the Carteret County Tax Office. Please contact them if you have any questions, or are interested in beginning the appeal process.

| Tax Office Divisions | |

|---|---|

| Appraisal | |

| 252-728-8485 | |

| Business Personal | 252-728-8486 |

| Collections | 252-728-8525 |

| Land Records / Mapping | 252-728-8490 |

| Personal Property | 252-728-8486 |

| Western Tax Office | 252-222-5833 |

| Fax | 252-732-2064 |